In "For the Prosperity of the People," Ashleigh Blatt advocates for a decentralized monetary system to promote financial autonomy and transparency. This article explores the growing interest in decentralized finance (DeFi) and examines the technical and adoption challenges associated with transitioning to such a system.

Blatt begins by highlighting the appeal of a decentralized monetary system, which offers an alternative to traditional centralized institutions. Cryptocurrencies like Bitcoin and Ethereum have popularized DeFi, presenting new financial solutions that promise greater financial autonomy. However, significant technical and adoption obstacles must be addressed to make this transition feasible.

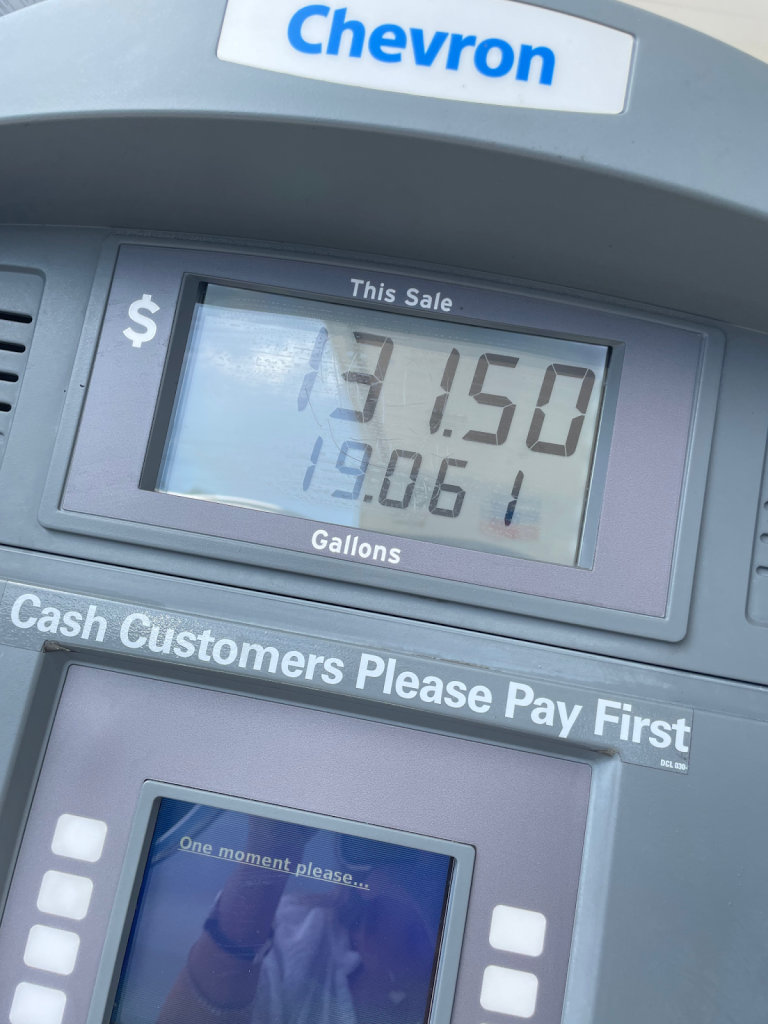

The complexity of economic issues, such as inflation, underscores the need for adaptable monetary policies. Blatt uses the example of soaring gasoline prices in California to illustrate how economic disruptions impact daily life and business operations. Rising operational costs and the interplay of economic forces emphasize the importance of robust financial frameworks.

Blockchain Scalability: Current blockchain networks suffer from slow transaction processing speeds, hindering their use for institutional transactions requiring high-volume processing.

Cryptocurrency Illiteracy: Many retail businesses lack the understanding and capability to integrate digital currencies into their operations.

Risk from Overcrowded Market: The vast number of cryptocurrencies creates uncertainty and risk, making it difficult for investors to discern valuable assets from speculative ones.

The article also discusses the role of blockchain technology in financial transactions, noting its limitations and the need for improved scalability and transaction speed. Innovations like the Lightning Network aim to address these issues, enhancing blockchain's utility for high-speed, high-volume transactions.

Blatt emphasizes the importance of widespread adoption among retailers and the need for scalable education to foster understanding of DeFi. The Financial Policy Council (FPC) plays a crucial role in promoting financial literacy and supporting the adoption of decentralized systems.

In conclusion, Blatt argues that the transition to a decentralized monetary system requires overcoming significant challenges but holds the potential for profound economic benefits. The FPC's efforts to educate and advocate for financial autonomy are pivotal in this evolving financial landscape.

For more information, visit Financial Policy Council.

For the prosperity of the people, we need a decentralized monetary system. A system that is not manipulatable by the powers that be. The purpose of this post is to discuss the growing interest in decentralized finance and analyze the feasibility and complexities associated with transitioning to a decentralized monetary system, including the technical and adoption obstacles that must be addressed.

The idea of having a decentralized monetary system, one that’s not easily influenced by those in power, has gained considerable traction in recent years. Many believe that such a system could promote the well-being of people by providing financial autonomy and transparency. This concept has been especially popularized by the rise of cryptocurrencies like Bitcoin and Ethereum, collectively known as decentralized finance (DeFi), which offer alternative financial solutions outside traditional centralized institutions. This intriguing area has sparked significant interest in exploring the potential implications and challenges associated with decentralized financial systems.

In the context of ongoing economic debates, it becomes evident that objective economic indicators play a crucial role in assessing the state of the economy. Metrics like the Consumer Price Index (CPI) provide concrete data to evaluate the impact of factors such as inflation on the daily lives of people.1 The complexity of these economic issues goes beyond political rhetoric, emphasizing the need for adaptable monetary and fiscal policies that can address these challenges effectively.

Take, for instance, the striking example of soaring gasoline prices in California on September 20th, when a gallon of gas reached nearly $7, resulting in over $130 bill to fill up a standard SUV’s tank.2 This dramatic increase in gas prices is influenced by various factors, including disruptions in the supply chain, geopolitical tensions affecting oil production, and the transition towards cleaner energy sources. Such price fluctuations have rippled through the economy, affecting nearly every common good or service we encounter.

Businesses across various industries are grappling with similar challenges as they face rising operational costs. While some enterprises strive to keep prices affordable for consumers, they are also coping with their own increased expenses. This dilemma underscores the complex interplay of economic forces, where cost pressures can be transmitted through supply chains, impacting both businesses and consumers.

The call for a decentralized monetary system, for the prosperity of the people, resonates with the need for a financial system that can navigate the complexities of today’s modern world. The ongoing debates about economic issues and real-world examples, like the high gas prices in California, underscore the importance of robust financial frameworks that can address these challenges. That said, the desire for decentralization with the practicalities of implementation remains a complex and evolving topic in the fields of geopolitics and economics.

The global shift towards the adoption of digital currencies and cryptocurrencies is an undeniable phenomenon, indicative of a significant paradigm shift in the financial landscape. Nevertheless, amid this sweeping transformation, there remains a degree of technical lack and misunderstanding preventing the full emergence of this technology today.

In this nascent realm of cryptocurrencies, we encounter a diverse spectrum of stakeholders, ranging from enthusiastic supporters to fervent skeptics. While the movement remains in its early stages and shows great trends toward adoption, it is worth noting that despite the overarching trend toward enthusiasm, only one million people of the global population hold just one single Bitcoin.

But still, cumulatively, hundreds of millions, if not billions, of dollars have been invested in the development of decentralized systems, stablecoins, and, yes, alternative cryptocurrencies too. These endeavors collectively aim to create an ecosystem where individuals can thrive economically, free from the specter of external manipulation.

It doesn’t matter if you are an enthusiast or a skeptic; the pertinent question remains of whether this change will materialize, how the transformation will come to fruition, and how everyday individuals can prepare themselves with the knowledge and tools needed to thrive amidst this evolving financial paradigm.

In today’s landscape, fundamental and infrastructure-focused challenges have impeded a seamless integration of a decentralized financial system into the mainstream. These intricacies warrant a deeper examination:

1. Inefficiencies in Blockchain Scalability: Foremost among these challenges is the inherent constraint posed by the sluggish transaction processing speeds within existing blockchain networks. This limitation hampers the feasibility of employing cryptocurrencies for institutional transactions that demand swift and high-volume processing capabilities.

2. Widespread Cryptocurrency Illiteracy among Retail Enterprises: A second challenge resides in the widespread lack of comprehension and practical ability concerning the integration of digital, decentralized currencies within our everyday retail businesses. The complexities surrounding the practical implementation of these digital assets remain a hurdle for the majority of retail entities.

3. Overcrowded Cryptocurrency Landscape Breeding Excessive Risk: The third predicament revolves around the overwhelming number of participants operating within the sphere or believing they are effectively operating in the space. This landscape has created an elevated degree of uncertainty and risk from which the everyday person or even entrepreneur would be hard-pressed to find quality, informed data.

The following information is where we will delve into the intricate nuances of these issues, discuss the forthcoming changes poised to address them and offer further insight on how to navigate the changes best as they come.

The pivotal role of blockchain technology in the financial realm, particularly concerning the requirements of large banks and institutional investors, necessitates a nuanced examination of its current limitations and evolving solutions. In essence, the ability to facilitate high-speed, high-volume transactions is the linchpin of effective engagement for these financial powerhouses. To put this into technical perspective, these institutions demand a staggering capacity and ability to process multiple million transactions per second for their commercial operations. This includes encompassing not only consumer and retail operations but also, crucially, institutional transactions. The sheer scale and velocity of global capital movement underscores the criticality of possessing the technical infrastructure to operate at such exceptional speeds.

Presently, the Bitcoin (BTC) blockchain, a pioneer in the decentralized monetary domain, is capable of executing a modest seven transactions per second.3 This throughput rate, while groundbreaking in its own right, falls short when it comes to enabling swift, large-scale transactions valued in the millions of dollars. The practical implication is that such transactions on the BTC blockchain could extend over several days, rendering them impractical for large global business operations. This glaring inadequacy compels the exploration of alternative blockchain ecosystems, each addressing unique niches and shortcomings in the evolving digital currency landscape.

For instance, Ethereum (ETH), a prominent blockchain platform, has strategically shifted its focus to accommodate smart contract creation and management, along with serving as a hub for data storage, among other functionalities. While this strategic pivot undoubtedly addresses specific industry needs and has contributed significantly to the broader blockchain ecosystem, it does not inherently resolve the overarching issue of scalability and transaction speed that acts as a bottleneck to mass adoption and large-scale financial operations.

Consequently, the blockchain landscape is witnessing a proliferation of diverse platforms, each seeking to carve out a distinctive niche, whether by enhancing transaction throughput, addressing scalability issues, or enabling specialized functionalities. In this dynamic environment, the pursuit of innovative consensus mechanisms, such as proof-of-stake (PoS) and sharding (splitting the blockchain network into multiple smaller component networks), represents tangible strides toward mitigating the bottleneck of slow transaction speeds and advancing blockchain technology to meet the demands of global business effectively.

The creativity and innovation here display the possibilities and indispensable role of blockchain technology in the financial sector, and that is fundamentally linked to its capacity to accommodate high-speed, high-volume transactions. The existing limitations, exemplified by the BTC blockchain’s transaction processing speed, underscore the pressing need for ongoing innovation within the blockchain landscape. The overarching challenge of scalability and transaction speed remains a formidable hurdle, necessitating continued exploration and advancement in blockchain technology to propel it into the realm of mass adoption and suitability for large-scale institutional transactions.

Yes, the implementation of technology capable of accommodating institutional investors and rectifying transaction speed issues represents a significant stride in the evolution of a decentralized monetary system. Nevertheless, improved speed and institutional access to the Blockchain do not equate to the mainstream use of such a system. The question remains: who will drive their customer base to utilize this decentralized technology for their intended purposes, especially concerning everyday consumer transactions? The sheer number of factors determining currency selection and consumer adoption is plenty, both intricate and straightforward.

As it stands, a decentralized monetary system’s adoption in consumer transactions remains pretty limited. For the cryptocurrency movement to transition towards a fully decentralized system, it is imperative that retailers, the essential bridge between consumers and cryptocurrencies, actively embrace and facilitate cryptocurrency transactions.

Currently, a select handful of prominent organizations, such as AMC movie theaters, Gucci, Starbucks, and Tesla, have ventured into the realm of accepting specific cryptocurrencies as a form of payment.4 This evolving trend underscores a growing acceptance of digital currencies within mainstream commerce. Notably, major credit card companies like Visa and Mastercard, alongside financial service giants such as PayPal and Venmo, are proactively expanding their capabilities to serve as intermediaries.5 They enable consumers to transact using cryptocurrencies by converting their digital assets into fiat currency or using them as credit, occupying a role that aligns with their traditional position as financial industry intermediaries.

However, the overarching challenge persists: the broad acceptance of cryptocurrencies as a formal mode of payment by retailers at large remains a work in progress. Major retailers are cautiously assessing and endorsing specific cryptocurrencies, and medium-sized and small businesses have been slow in formally embracing this transformative payment method. The crux of the issue lies in achieving mass adoption, an essential prerequisite for the sustainability of a decentralized monetary system post-creation.

Ultimately, the introduction of technology solutions catering to institutional investors and transaction speed enhancement represents pivotal milestones in the cryptocurrency realm. Nevertheless, the consumer adoption and widespread acceptance of cryptocurrencies within the retail sector also present important, intertwined complexities. Encouragingly, an increasing number of major players and intermediaries are facilitating the integration of digital currencies into everyday transactions.

Amidst the ever-evolving landscape of cryptocurrencies and the push to a decentralized monetary system, there are far too many “cooks in the kitchen” offering nuanced perspectives, each of which warrants deeper exploration. With such an abundance of information, there is also a deep misunderstanding and lack of understanding of the movement as it stands.

Reality persists in the form of information overwhelm as the online landscape is inundated with content, much of which lacks the depth and quality necessary for fostering a comprehensive understanding of the industry. This predicament is a byproduct of the multifaceted nature of the internet today. It predominantly serves as a dual-purpose platform: a fertile ground for profit generation, characterized by sensationalist content and attention-grabbing tactics, and a vehicle for the propagation of agendas and narratives, irrespective of ideological leanings.

Regrettably, this internet structure has not contributed significantly to truly understanding the current state of the decentralized monetary system and the pivotal strides it is undertaking. The overwhelming prevalence of self-promotional causes and the scarcity of impartial, well-rounded information further muddle the landscape, making it challenging for the average individual to navigate the complexities of the cryptocurrency industry.

Moreover, the sheer proliferation of cryptocurrencies, numbering approximately 6,300, with nearly 1,800 having met their demise, poses a formidable quandary for everyday investors.6 The question remains: which cryptocurrencies hold genuine value, which are integral to a dynamic and expanding ecosystem, which resemble speculative penny stocks, and which mirror blue-chip stocks remains a daunting task. The lack of clarity surrounding the environment and factors that render one cryptocurrency more valuable than another, coupled with the online discourse, creates more volatility rather than a profound and informed understanding of the field.

While there are commendable strides are being made to resolve technical impediments and to provide information, there is an urgent need to cultivate a more substantial and informed understanding of the field, counteracting the information overwhelm and facilitating the true understanding of changes as they come. These efforts, alongside ongoing infrastructure enhancements, collectively shape the trajectory of the decentralized monetary system as it navigates the evolving tides of the digital era.

The scalability of the BTC Blockchain has been a topic of considerable discussion and development in recent years. As mentioned, the BTC Blockchain currently processes around seven transactions per second (TPS), which has been a limiting factor for its widespread adoption in various use cases. However, the forthcoming upgrade with the Lightning Network, among other technologies, is poised to revolutionize the BTC Blockchain’s transaction throughput.

The Lightning Network is a layer-2 scaling solution designed to enable faster and more cost-effective microtransactions on the Bitcoin network.6 It leverages a network of payment channels to facilitate off-chain transactions, alleviating the congestion on the main blockchain. This is simply one of the technologies coming to the BTC Blockchain upgrade, which is poised to have, at minimum, enough TPS so the institutions will be able to transact at the commercial level they require.

This prospect itself is indeed groundbreaking. This level of scalability aligns with the requirements of commercial institutions, which often demand high throughput to handle their own extensive transaction volumes efficiently. This development is a game-changer, as it opens the door for prominent organizations and financial institutions to fully harness the capabilities of the BTC Blockchain for a wide range of applications.

Moreover, the global accessibility of this upgraded BTC Blockchain is a pivotal aspect of its potential impact. With over 200 countries working on digital currencies and then having the true technical capabilities for transition, the required financial infrastructure is then ready for mainstream and global use.8 This level of inclusivity and global reach has the potential to facilitate cross-border trade, remittances, and financial services on an unprecedented scale.

The upgrade not only enhances the utility of Bitcoin as a digital asset but also positions it as a formidable contender in the realm of global finance. As more institutions, governments, and businesses explore the possibilities of utilizing the BTC Blockchain for various applications, it could lead to increased adoption and integration of cryptocurrencies into mainstream financial systems.

This forthcoming upgrade to the BTC Blockchain, particularly the integration of the Lightning Network and other new technologies, makes its potential to process TPS in the millions marks a pivotal moment in the evolution of cryptocurrencies. It has the capacity to transform the way institutions and individuals engage with digital assets and global finance, fostering a new era of innovation and economic opportunities on a global scale.

For investors, these innovative solutions unveil a panorama of promising prospects. Companies like MicroStrategy (symbol: MSTR), which have strategically invested substantial resources into BTC, have done so not solely because they are a “Bitcoin Enthusiast” but because it was a better value and hedge against holding onto cash, especially during inflationary periods as we observe today.9 In addition to enterprises like MicroStrategy, exchanges like Nasdaq (symbol: NDAQ) have listed Bitcoin and Ethereum financial products to meet demand. Trusted crypto wallets and trading platforms such as Coinbase (symbol: COIN) enable easy access for retail investors, thereby ushering in a new era of financial inclusion.

A not-so-distant past reminds us of a time when the notion of summoning a restaurant menu with a QR code was completely foreign, and the technical wizardry behind how that happened was a mystery. Yet, the remarkable adaptability of even mom-and-pop restaurants during the COVID-19 era saw them swiftly embracing this technology for the sake of safety. What once felt like a novel concept has become an everyday practice. Similarly, the mere act of payment transformed from card swiping to the seamless tap of a credit card or smartphone, facilitating instant transactions for a range of goods and services, including the simplest of meals at a neighborhood hangout.

Intriguingly, this new and modern practice of digital payments, wherein cards and smartphones serve as conduits for financial transactions, hints at a future where digital currencies play a more central role in our daily lives. While the transition to fully-fledged digital currency payments may appear distant, the reality is that the groundwork for such a shift is subtly taking shape. Retailers and businesses are agilely adapting to emerging technologies, an evolution similar to the choices we make when selecting a credit card for payment.

Consumers may soon find themselves deliberating over which digital currency to use for their transactions, much as they currently weigh the merits of various credit cards. Again, the underlying technological infrastructure is already in place, enabling retailers, both large and small, to seamlessly accept decentralized digital payments and assert ownership over this transformative process. The stage is set for an era where the boundaries between traditional and digital currencies blur as consumers and businesses navigate the evolving landscape of financial technology.

As global institutions come together to harness the potential of blockchain technology and the leading cryptocurrencies in alignment with their intended purpose, the decentralized and digital financial movement gains the adoption it’s looking for on a global scale. This transformative shift is marked by a notable emphasis on high-quality information dissemination, a departure from the pervasive clickbait and propaganda prevalent in today’s digital age. Leading figures in the world of business and finance are embracing this movement, now being open about their embracement, and hold a very real and profound recognition of the far-reaching implications and its closeness to mainstream adoption that we are.

In this dynamic landscape, individuals seeking to enhance their understanding and skills in the realm of decentralized finance find valuable resources in organizations like the Financial Policy Council. Beyond offering foundational education, these institutions provide an invaluable reservoir of groundbreaking insights and wisdom shared by industry leaders deeply committed to nurturing the ecosystem. The Financial Policy Council serves as an exemplary example in this regard, offering an avenue for individuals to enrich their knowledge, transcend the confines of the status quo, and make informed choices aligned with the aspirational ideals envisioned by the Founders—a journey toward realizing the American Dream in the context of an evolving financial paradigm.

For the prosperity of the people, as the Founders envisioned, the encouraging facet of this movement is the focused and concerted efforts being undertaken to resolve the technical impediments that have occurred in the decentralized financial monetary sector and its growth. This represents a crucial aspect of the industry’s maturation, reflecting the ongoing commitment to enhance its structural integrity and functionality. Technical advancements, such as scalability solutions, consensus algorithm innovations, and security enhancements, are actively contributing to the rectification of these issues, thereby fortifying the industry’s forward momentum.

Despite the challenges, it is crucial to recognize that positive actions aimed at addressing the fundamental infrastructure issues that have impeded the decentralized movement. These endeavors, ranging from collaborative research initiatives to the development of standardized protocols, are instrumental in steering the industry toward a future characterized by increased stability, accessibility, and comprehension.

Yes, it’s true that with such significant changes ahead come regulatory and security considerations. Regulators worldwide are actively working towards incorporating the evolution of digital and decentralized monetary systems, including the BTC Blockchain, to ensure compliance with existing financial laws and to address potential risks such as fraud and money laundering. The need for robust security measures to protect the network against attacks will also be paramount. Frankly speaking, these are good things, as we want interaction and cooperation in a spirit of togetherness, accomplishment, and growth.

The global movement towards digital currencies and a decentralized monetary system is not “if” it will happen but “when” and stands as an irrefutable testament to the winds of change sweeping through the financial world. The coexistence of both proponents and skeptics underscores the complexity of this transition. With substantial investments and developments underway, the transformation of the financial industry is, indeed, underway. It’s imperative that individual readiness amps up so they may navigate this era of transformative change and the people may prosper.

Readers can capitalize on this transformation and natural opportunities within the evolving landscape of decentralized finance by adhering to a strategic framework that encompasses the following actionable steps:

The FPC recognizes decentralized systems as central to widening economic participation and prospering individuals. This spirit of empowerment through financial autonomy resonates deeply with the FPC’s goal of fulfilling the promise of capitalism.

Learn more from the FPC or explore specific investment opportunities.

If you have found this publication to be a source of value and are inclined to deepen your engagement, we invite you to contemplate contributing your resources, be they in the form of time, energy, capital, or online support, to bolster further the impactful initiatives undertaken by the Financial Policy Council. Visit www.financialpolicycouncil.org or www.linkedin.com/company/financial-policy-council/ to learn more.

#decentralizedfinance #Defi #cryptocurrency

*Disclaimer: This article should not be construed as investment advice or recommendations to purchase any specific stocks or cryptocurrencies. The companies mentioned are used for illustrative purposes only. Investing involves risks, and investors should conduct thorough research before making any investment decisions. The author and publisher do not provide investment advice and are not liable for any trading or investment losses. Consult a certified financial advisor for personalized guidance before investing.

Disclaimer: This article discusses certain companies and their products or services as potential solutions. These mentions are for illustrative purposes only and should not be interpreted as endorsements or investment recommendations. All investment strategies carry inherent risks, and it is imperative that readers conduct their own independent research and seek advice from qualified investment professionals tailored to their specific financial circumstances before making any investment decisions.

The content provided here does not constitute personalized investment advice. Decisions to invest or engage with any securities or financial products mentioned in this article should only be made after consulting with a qualified financial advisor, considering your investment objectives and risk tolerance. The author assumes no responsibility for any financial losses or other consequences resulting directly or indirectly from the use of the content of this article.

As with any financial decision, thorough investigation and caution are advised before making investment decisions.