In "Decentralized Private Market Advantages in Turbulent Times," Aaron Smith, Alex Polkovsky, and Bret Siarkowski discuss the benefits of decentralized markets amidst growing distrust in centralized systems. The authors argue that decentralized strategies, entrepreneurship, and innovation are key to navigating economic turbulence.

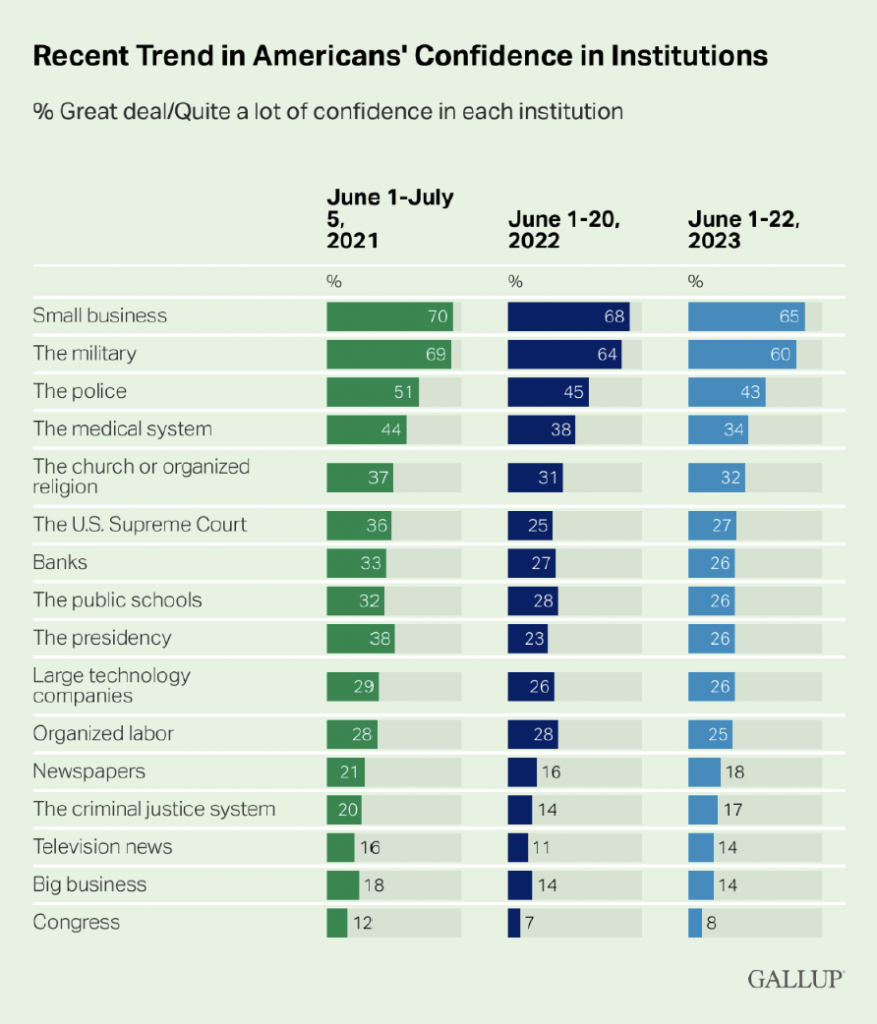

The article contrasts the failings of centralized institutions with the potential of decentralized systems. Centralized bureaucracies, plagued by inefficiencies and scandals, have eroded public trust. In contrast, decentralized models offer accountability, community control, and innovation.

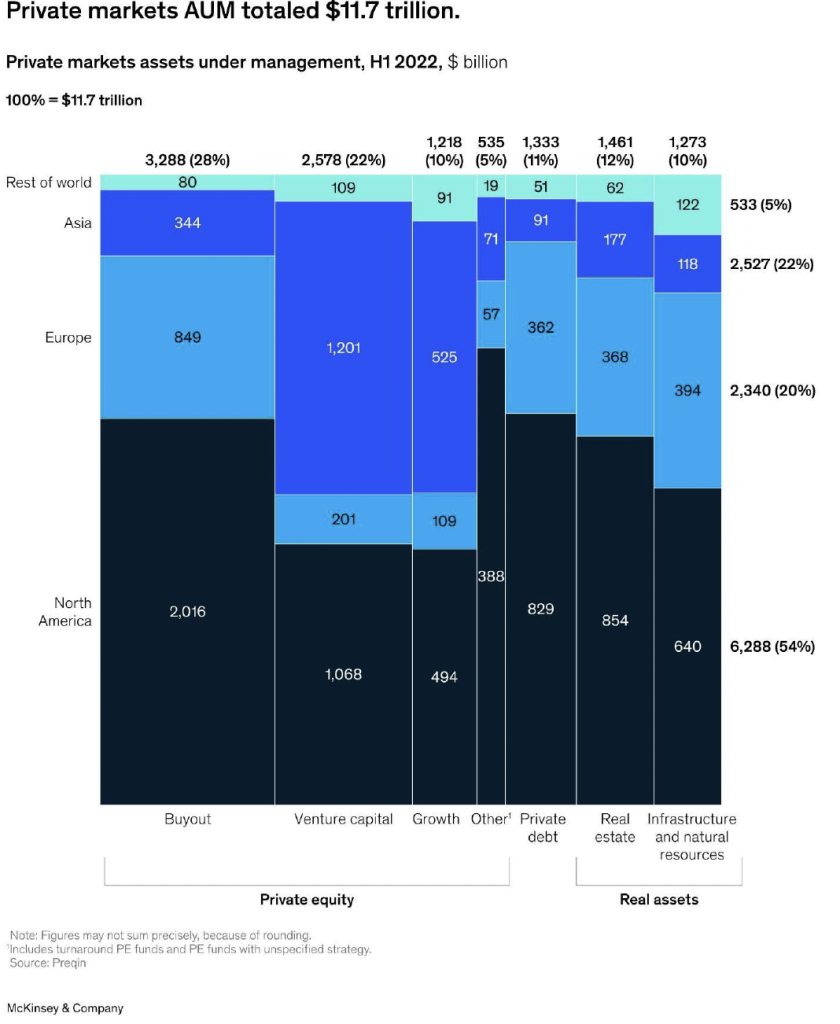

The shift towards decentralization is evident in investment patterns. In 2021, private capital markets saw a 10% increase, reaching $11.7 trillion, while public markets saw minimal net inflows. The authors emphasize that private markets, including venture capital and private equity, offer superior returns and are increasingly accessible.

Decentralized systems foster competition, distribute wealth more equitably, and enhance resilience against external shocks. Examples include blockchain technologies, co-operative business models, and independent sponsors, which are gaining market share and driving innovation.

The authors argue that decentralization, rooted in America's founding principles, can reinvigorate economic growth and restore public trust. Embracing decentralized models across business, technology, and governance can create new opportunities for entrepreneurs and investors, aligning with the Financial Policy Council's mission to promote sustainable economic growth.

For more information, visit Financial Policy Council.

“The struggle between centralization and decentralization is at the core of American history.” Anthony Gregory

Our broader society and ways of life are being hacked and undermined at a level not previously encountered by most living generations today. Nearly every system of centralized establishment that governs our everyday lives have epically failed by any conceivable measure and oftentimes on multiple occasions. The financial sector is no exception. Such ever-growing centralized systems can be counted on to continue to do so unless they are course-corrected or avoided altogether.

Fortunately, private markets still currently provide ample opportunities to monetize for those that are paying attention. Decentralized strategies and the entrepreneurial spirit of innovation, boldness and a contrarian mindset lie at the heart of the solution, just as they have since 1776. In fact, we would argue this is the greatest time in human history to be both an entrepreneur, as well as possess a contrarian, critical thinking mindset, with an opportunity to truly reshape the future unlike ever before.

America stands at an historic juncture, confronting deep challenges related to the failings of centralized systems that have long formed the backbone of our economic and governmental institutions. This centralized approach traces back to the founding of the nation, with Alexander Hamilton advocating for a strong central government and centralized banking system. Over two centuries, faith in centralized authority continued expanding across both the public and private sectors. However, cracks have emerged in this foundation, evidenced by the following trends:

While centralized systems brought past progress, today decentralization offers a compelling path forward. Smaller decentralized units can enhance accountability, community control, competition, innovation, and wealth distribution. However, decentralization also introduces potential risks around security, efficiency, and coordination across disparate entities. Still, America stands at a pivotal juncture, where harnessing the power of decentralized models across business, technology, economics, and governance could reinvigorate growth and restore trust. The opportunities for entrepreneurs and investors willing to embrace this transformation are immense.

In every centralized attempt, which inevitably crumbles, there are new seeds of innovation and opportunity planted. With the fruits available to be harvested by those willing to see beneath the currents of unstable change unfolding before their own eyes.

Take for example Traditional Taxis vs. Ride-Sharing. Centralized taxi companies, often heavily regulated and controlled by local authorities, faced challenges when ride-sharing platforms like Uber and Lyft introduced decentralized, peer-to-peer transportation options. This shift disrupted the taxi industry and created new opportunities for drivers and entrepreneurs.

Another example includes the Collapse of Lehman Brothers and the Emergence of Fintech. The 2008 financial crisis, triggered in part by the collapse of Lehman Brothers, exposed flaws in the traditional centralized banking and financial system. In the aftermath, financial technology (FinTech) startups emerged to address inefficiencies and provide alternative financial services, such as peer-to-peer lending and mobile payments.

And a third example – Music Industry’s Transition to Digital. The music industry initially struggled to adapt to the digital era, with centralized record labels resisting online distribution. However, the advent of digital music platforms like iTunes and later streaming services like Spotify transformed the industry and changed how artists distribute and monetize their music.

The hunt for the ever-higher market yield is going to only intensify over the near-term – only those armed with the most dynamic and fluid intelligence, with access and innovative business models will thrive. The rest will either struggle to stay afloat, become a self-consuming relic at the tail-end of its maturity cycle or get wiped out altogether, as earlier mentioned examples illustrate.

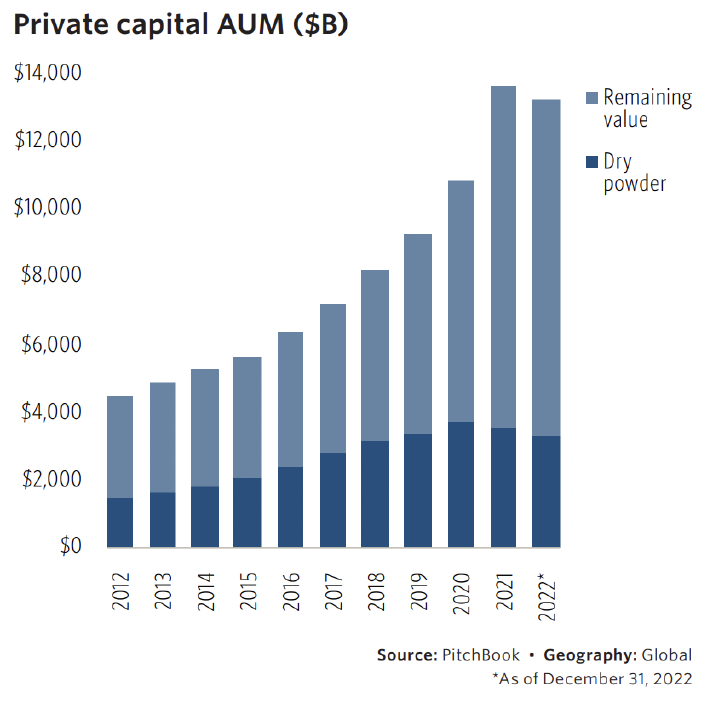

In 2021 alone, global assets under management (AUM) in the private capital markets surged to over $9 trillion, a 10% increase from the prior year. Sitting at $11.7 trillion as of June 20225. Meanwhile, public markets saw net inflows of only $400 billion globally as investors lose faith in centralized systems, a decrease of 61.2% Y-o-Y6. The tide is rapidly shifting.

Let us take a deeper look at where the current global markets sit in terms of their respective capitalizations and uncover just some of the innovative underlying trends available to shrewd investors and market participants alike.

Our planet Earth, consisting of an aggregate of all primary assets (not including derivatives and exotic financial instruments, government debt levels, etc.), is run by two markets – public and private – with the traditional public markets business model holding the largest percentage of those assets, currently sitting at over $101 trillion7 as measured by market capitalization. Compared to the private markets as measured by AUM, the public markets are about 8.5:1 in scale. The most common data measurement tools between the two sectors are not direct apples-to-apples comparisons but do provide a relatively accurate reference scale.

The first one being a public mandate – an illusory ownership model for the average retail person, and in practical reality a centralized machine run by ulterior interests, and layered with governance and regulatory red tape that’s beyond business-conducive – is losing steam. And quickly.

The second one being the private mandate, which generally includes venture capital, private equity, real estate and hedge funds – traditionally considered an alternative asset class only available to the ultra/high-net worth individuals and institutional players – is on a rapid rise, breaking out of the “alternative” asset label at a nearly 20% Y-o-Y rate since 20178.

Over the past decade, total assets under management by private markets has grown at a compound annual rate of 10%, from $5 trillion in 2012 to over $11.7 trillion by June 20229.

Moreover, during the same period, public market assets contracted by 2% annually as investors pulled out capital. Private markets now account for over 15% of total global assets, up from just 8% a decade ago – a nearly 100% increase in market share.

We believe the private markets will provide a much more compelling business case to investors and market participants alike for the foreseeable future. Given the overall markets’ turbulence that has not worked its way through the global markets in full form, as of the date of this publication (2023 Q3), shrewd investors should further explore this “alternative” asset class and the ample opportunities for monetization that it provides.

Separate from superior historical year-over-year returns that are typically achieved by various participants in the private markets, the common thread that can be observed unmistakably is the trend away from the established, stale central command-and-control systems and towards decentralized models built around technological competitive advantage, innovative entrepreneurial business models and addressing the underserved markets, among others. Pioneers and early market adopters are making this previously exclusive club accessible to a much broader audience – let’s explore how.

Marriam-Webster dictionary defines “centralize” as “1: to bring to a center: CONSOLIDATE; 2: to concentrate by placing power and authority in a center or central organization”10. Although typically referenced in the mainstream channels primarily in relation to the political arena, the true depth of centralization efforts reaches into every man-made system of organization, including how we conduct commerce and financially interact among each other. Such centralized systems usually always end on a long-term agenda that is much more concerned with gaining power and control at any cost then it is with creating shareholder value – the lost forgotten art it seems.

Public (and often large-scale private) monopolistic, oligopolistic, globalist or for that matter, cartel-like corporate structures are the primary net job destroyers in our economies, not job creators such as the new, small, regional businesses under 5 years old typically are11. At the mercy of their corporate “stakeholders”, large public players of all variety are traditionally the ones responsible for ordering in the new leadership policies that everyone is expected to align to such as the Diversity, Inclusion and Equality (DIE) initiatives and Environmental, Social and Governance (ESG) models to name a few, all of which are so remarkably ineffective and we would argue are not in alignment with the expectation of its broader public shareholder base. Only the proxy voters it seems. Recent examples of Target (NYSE: TGT) and Anheuser-Busch, the parent of Bud Light (NYSE: BUD) as fresh examples of creating “stakeholder value” through such strategies speak for themselves.

Sticking to these centralized, self-destructive strategies will inevitably yield a financial underperformance in the long-term for the investors. The implications of relying on centralized public markets go far beyond just financial underperformance for investors. Centralized systems consolidate power into the hands of the few, stifle innovation, restrict choice, and often fail to serve their underlying stakeholders.

Just examine the recent major failures of oversight, ethics, security, safety, and fiduciary duty in large, centralized institutions, with the FTX collapse in 2022, the Facebook/Meta scandals and Google’s $9 billion European antitrust fines to illustrate the risks around consolidation of power and lack of accountability.

Further, short-term thinking in public markets discourages investments into longer-horizon innovations required for societal progress, often cutting corners on issues such as necessary infrastructure maintenance, upgrades, technological investments and security, just to name a few. All of these in a cumulative effect ultimately result in a decreased overall competitiveness of both the private and public markets, reduced consumer confidence, gradual devaluation of the underlying currency and general societal breakdown – not to dissimilar to events currently unfolding.

Decentralization as defined by the Marriam-webster dictionary as 1: the dispersion or distribution of functions and powers; specifically, government; the delegation of power from a central authority to regional and local authorities12. And in fact, it’s quite to-the-point. The actions we all independently take, consciously executed or not, will always yield the combined cumulative effect of those choices. Pushing for variety of decentralized systems in lieu of more centralized structures naturally creates more resilient structures that are less prone to external disruptions.

Think of a single power plant powering all of the US economy from one fuel source vs. 1,000 independent, self-administered independent power producers running multi-source plants. Which one do you believe will withstand an external shock more effectively and with minimal disruption? Same applies as to why the private markets and their respective, innovative business models are gaining so much appeal, growing market share and are quite literally disrupting the power balance that’s been historically at play. The time to capitalize on this tremendous opportunity could not have been more aligned.

In the private “alternative asset” markets, a number of hidden opportunities are available to astute investors and market participants alike, examples of which include:

The push towards decentralization across markets parallels the rise of the internet and movement of information out of centralized servers into distributed networks. Just as decentralized information flows empower users, decentralized finance puts control back into the hands of investors and innovators alike.

Embracing decentralized models will unlock new waves of innovation, create more equitable access to opportunities, foster stronger alignment between stakeholders and decision-makers, and build resilience against instability. We strongly encourage every astute investor and market participant alike to expand their participation in the private markets and consider more decentralized business strategies in their investment decisions.

Ultimately, the deep-rooted and proliferating centralization observed across pivotal American and global institutions has stifled the innovation and problem-solving enabled by decentralized networks.

Concentrating power into fewer hands has weakened accountability and aligned entire systems to narrow interests rather than the public good. While central planners once brought important structure, the manifold failures of governance, ethics, security, and incentives expose the vulnerabilities of excessive consolidation. These lapses diminish investor returns, entrepreneurship, and economic dynamism.

However, America stands at a crossroads, where emerging technologies and shifting cultural attitudes provide a monumental opportunity. By transitioning towards decentralized models founded on transparency, competition, and democratic controls, we can reignite participatory engagement and shared prosperity.

As this piece illuminated, decentralized finance, autonomous communities, open-source technologies, and peer-to-peer networks demonstrate pathways aligned with our highest Constitutional principles and national ethos. Our imperative now is accelerating this transformation across all sectors.

A future defined by decentralized capital formation, governance, media, and infrastructure promises to unlock new eras of wealth creation for investors and entrepreneurs. But progress requires relinquishing assumptions that concentration of power fosters stability. The tide is turning towards decentralization – those who recognize and embrace this epochal shift will shape history.

As stewards investing in America’s future, our charge is to exemplify the courage and imagination needed to reinvent institutions around decentralization’s immense possibilities. This will honor the maverick spirit that founded our exceptional nation. The future remains unwritten – and awaits our audacity.

The Financial Policy Council, which the authors are deeply connected with and are a part of, is intent with promoting long-term sustainable economic growth and wealth creation within the financial industry. The FPC’s mission is to develop sound, public policy based on free enterprise and wealth development principles, fostering an environment that encourages innovation and prosperity in line with the nation’s founding ideals. By empowering entrepreneurs, investors, and the public to influence policymakers through advocating for public policy solutions that support the financial sector, the FPC helps safeguard the American spirit of progress and opportunity.

The FPC’s proposals for decentralized shared ledgers aimed at streamlining financial reporting have been at the forefront of the FPC’s thought leadership efforts across seminars, publications, and engagement initiatives thus validating its thought leadership in this arena.

As an authoritative watchdog on tax and regulatory policy, the FPC has long advocated for decentralizing oversight through legislative reforms and judicial challenges to concentrated bureaucratic power. It launched the Legacy Matters section of its website to advise businesses and individuals on navigating centralized tax regimes through education and planning.

The FPC further champions financial independence and entrepreneurship by working to instill a contrarian, independent spirit in young Americans. Its various seminars and blogs nurture future leaders and innovators with the agency to chart their own paths.

Through an engaged membership network and feedback channels, the FPC maintains a pulse on the needs of those seeking greater self-determination. It gives voice to the frustrations with encroaching centralized authority across government and corporate spheres that stifle individual liberties.

By continuing to lead through policies, initiatives, and platforms that decentralize control and empower people to take ownership of their economic futures, the FPC personifies the conservation maverick ethos that built the American promise of independence and prosperity.

If you found this publication valuable and are looking to get getting further involved, please consider contributing your time, energy, capital and/or on-line support of the work our team at the Financial Policy Council undertakes.

Visit www.financialpolicycouncil.org or www.linkedin.com/company/financial-policy-council/ to learn more.

We greatly welcome any feedback on the subject, recommendations or coverage that would be of special interest to our reader audience in future releases.

#decentralizion #economy #entrepreneurship #innovation #privateequity #venturecapital

i Disclaimer: The authors of this article are affiliated with Canam Asset Management and Softeq Venture Fund. This content is intended for informational purposes only and should not be construed as investment advice or an endorsement of any particular investment, strategy, or product. Always consult with a qualified financial professional before making any investment decisions. Past performance is not indicative of future results.

Sources:

Disclaimer: This article discusses certain companies and their products or services as potential solutions. These mentions are for illustrative purposes only and should not be interpreted as endorsements or investment recommendations. All investment strategies carry inherent risks, and it is imperative that readers conduct their own independent research and seek advice from qualified investment professionals tailored to their specific financial circumstances before making any investment decisions.

The content provided here does not constitute personalized investment advice. Decisions to invest or engage with any securities or financial products mentioned in this article should only be made after consulting with a qualified financial advisor, considering your investment objectives and risk tolerance. The author assumes no responsibility for any financial losses or other consequences resulting directly or indirectly from the use of the content of this article.

As with any financial decision, thorough investigation and caution are advised before making investment decisions.