As we navigate the complexities of the financial world, this space will serve as our platform to share insights, discuss trends, and explore the policies shaping our economic landscape.

Can the mismanagement of the #FederalReserve lead to much bigger problems?

Remember September 15, 1992 ? The two most powerful financial officials in the British government held an urgent meeting that night to review their plan for when the markets opened the next morning. The major reason being that the value of the British pound had been falling for weeks.

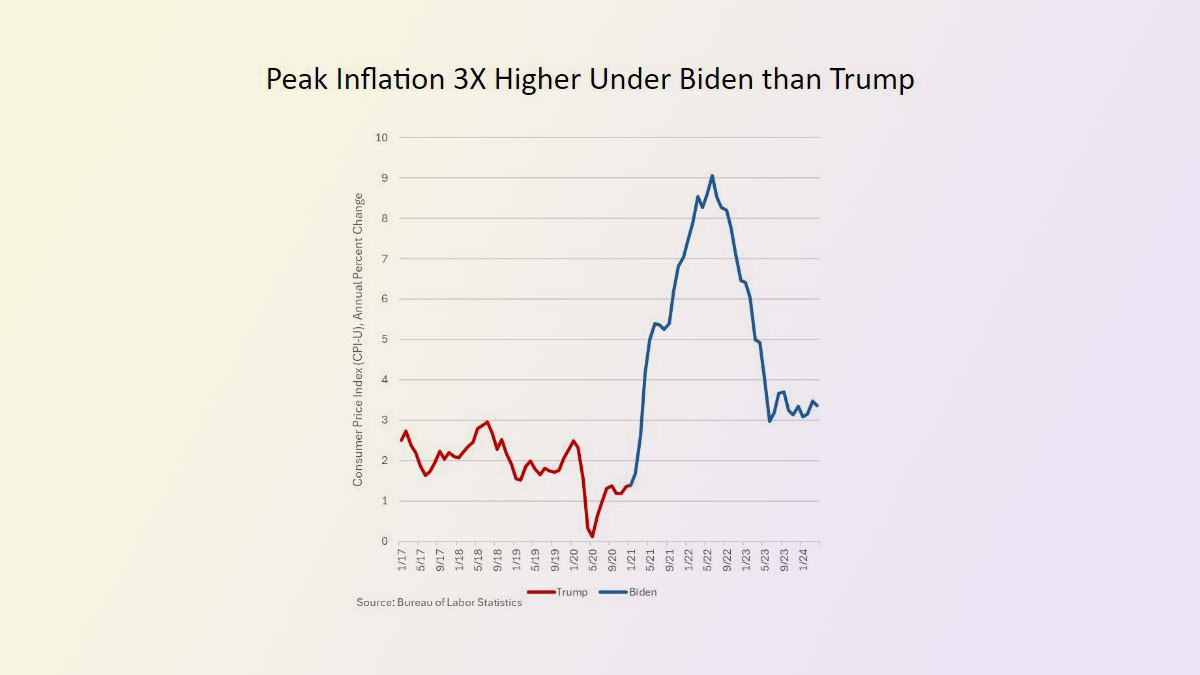

Investors and speculators were rapidly losing confidence in the UK government, mostly due to the ridiculous “Exchange Rate Mechanism” (ERM) which essentially pegged most European currencies to the German Deutschemark. By the summer of 1992, inflation in Britain was more than 3x Germany’s. Plus, Britain had a major budget deficit.

So, traders began short selling the British pound, i.e. betting that the value of the pound would fall because the British government would devalue its currency.

One of those speculators was George Soros, (The Man Who Broke the Bank of England) who famously bet $10 billion against the British pound… far exceeding the Bank of England’s financial resources and made over $1 billion in profits out of his astute play.

By the end of that day, the British central bank was essentially bankrupt.

The Federal Reserve is already insolvent. According to its most recent annual financial statements, the Fed has just $51 billion in equity, versus a whopping $948 billion in mark-to-market losses. This means the Fed is insolvent by roughly $900 billion.

Remember that the Fed is still a bank, i.e. it has financial obligations, liabilities, and depositors that it needs to pay. For example, commercial banks like JP Morgan and Bank of America have deposited a total of $3.4 trillion of their customers’ money, i.e. YOUR money, with the Fed. The Treasury Department holds another $700 billion deposit at the Fed. Also, the Fed owes money to foreign governments. They owe trillions of dollars from repurchase agreements to banks and businesses across the global financial system.

So, yeah, the insolvency of the Federal Reserve is a pretty big deal. And just like the Bank of England in 1992, sooner or later, I believe some big shot financiers are going to start betting against the dollar… just like speculators bet against the pound three decades ago. And that would ultimately reduce the value of the dollar, increase inflation, and trigger a new ‘Bretton Woods’ agreement in which the US dollar is no longer the world’s reserve currency.

This is why I believe it makes so much sense to hedge these risks by owning real assets which are scarce, valuable, and uncorrelated to the US dollar.

Gold is a great example. And as I have argued before, even though it’s already near its all-time high, I believe it can go much higher from here.

What do you say?

Come to the Financial Policy Council https://lnkd.in/eZU2UgYd, be a part of decisions that will shape the country’s future & share your thoughts.

Forecasting our Future January 2, 2025

Want to truly Drain the Swamp? December 15, 2024

Will Trumpism Go Global? December 8, 2024

Obliterating The Socialist/Communist Ideology for Good December 4, 2024

My Personal Opinion on Trump’s Dream Team November 19, 2024

Goodbye Washington Establishment October 25, 2024

Kamala Reinvents Freedom August 26, 2024

Why Kamala Harris has no chance August 21, 2024

AI and the destruction of America August 19, 2024

Have you ever thought about our future? August 17, 2024

Have you ever wondered what was the hashtag Reagan Revolution about? August 15, 2024

It’s ALL about Attitude folks August 9, 2024

About today’s new class of bureaucrats who call themselves “elite” August 5, 2024

Freedom or Slavery? Time to Choose August 3, 2024

Bitcoin’s Future August 1, 2024

Unlocking the Biden – Trump Quagmire July 4, 2024

Surviving and Prospering During the Upcoming Mayhem June 27, 2024

When People Have No Idea What They are Talking About…. June 25, 2024

Looking at the Future June 13, 2024

Luminaries at their best June 10, 2024

Money, Power, Control & Crypto June 8, 2024

Are you still looking for Liberty and Freedom or have you given up on it? June 6, 2024

Globalism and the New World Order will not survive May 31, 2024

Can the mismanagement of the Federal Reserve lead to much bigger problems? May 29, 2024

Is the Fed really this mindless? May 22, 2024

The Great American Wealth Creation Machine May 18, 2024

How Illiterate our Financial Press Is May 16, 2024

Are we headed to gasoline prices of $100/Gallon? May 14, 2024

Will Bitcoin determine the fate of the 2024 Elections? May 11, 2024

Is Everything on Social Media Fake? May 8, 2024

Is America headed for a Civil War? May 5, 2024

It’s the Economy Again ….. Stupid April 29, 2024

Why is the US Dollar in Big Trouble? April 25, 2024

Deepening Your Due Diligence Procedures April 20, 2024

Meet the Three “Powerbrokers” behind the Climate Change Agenda April 17, 2024

You own nothing and THEY will be happy April 15, 2024

Assessing Bidenomics track record April 13, 2024

How Private Interests Seized Control of America April 10, 2024

The Art of the Brainwash April 8, 2024

When Envy Meets Stupidity April 1, 2024

My Personal Forecasts for 2024 March 31, 2024

Taking Back Our Country March 30, 2024

Righting the Wrongs of Capitalism March 29, 2024

America’s Existential Threat: How real is it? March 27, 2024

Breaking Free March 26, 2024

Is the Justice Department Killing Capitalism? March 22, 2024

Let’s be honest folks March 19, 2024

Are we Done with the Western World? March 17, 2024

Why Time Has Come to Disobey? March 16, 2024

Revealing the World Economic Forum March 15, 2024

For those of you still rooting for Biden – Let this sink in March 14, 2024

What is the ladder out of poverty? March 13, 2024

What is turning the United States ‘Socialist/Communist’? March 11, 2024

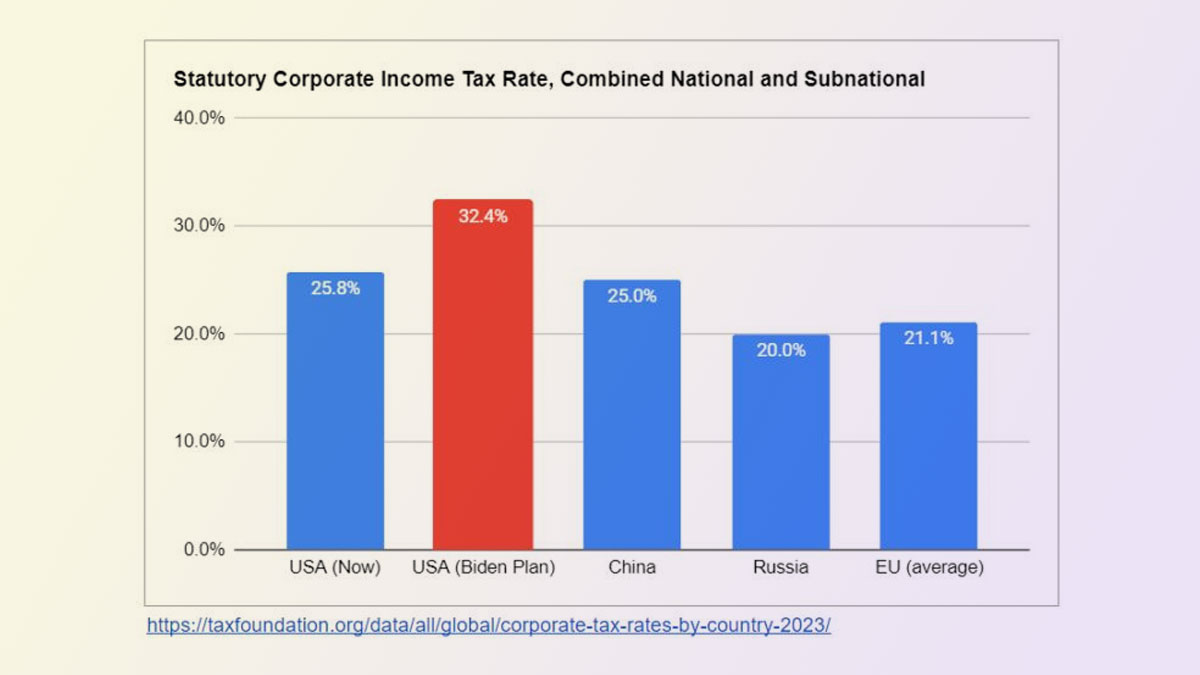

Growing the Economy With a Soak the Rich Tax Plan? March 8, 2024

Which presidential candidate should we vote for? March 6, 2024

Why your business proposals are failing March 1, 2024

Still a Puppeteer to the Puppet Masters? February 27, 2024

Unlocking the Master Code to Success February 24, 2024

An Open Letter to the “Global Elite” February 22, 2024

What is going on with our US Foreign Policy? February 19, 2024

Understanding the Billionaire Mindset February 16, 2024

Renewing Wealth Creation and the American Dream February 12, 2024

When Power Goes to People’s Heads February 8, 2024

Do you have what it takes to pitch to smart money? February 4, 2024

Smart v/s Dumb Money: How do you differentiate January 31, 2024

Why do so many socialists view making money as “Evil”? January 17, 2024

If you are so smart why aren’t you rich? January 12, 2024

Note: The Financial Policy Council (FPC) is a registered 501(c)(3) non-profit organization. This means that your generous donations to support our mission and initiatives are tax-deductible to the fullest extent permitted by law. To claim your tax deduction, please keep a record of your donation, including the date, amount, and any correspondence you receive from the FPC acknowledging your contribution. You should consult with your tax advisor to determine the specific tax benefits available to you based on your individual circumstances.