As we navigate the complexities of the financial world, this space will serve as our platform to share insights, discuss trends, and explore the policies shaping our economic landscape.

It is a mathematical fact that gasoline in the U.S. will eventually rise to $100 for a gallon (perhaps $130 for those interested in higher octane).

This is not fear-mongering, but basic arithmetic and economics. Here’s why.

The price of goods and labor is directly linked to money supply and market factors. This is not merely “supply and demand” economics, but an issue of overheating (or overleveraging) an economy by printing and/or borrowing too much money. When a government prints more money than the underlying economy is generating in real wealth, this is essentially a form of borrowing, often called “debt monetization.”

The United States has been doing this for decades, staving off the ordinary fluctuations in the economy punctuated by innovations and growth alternating with recessions – borrowing money in times of turmoil softens the blow, but also forestalls the consequences.

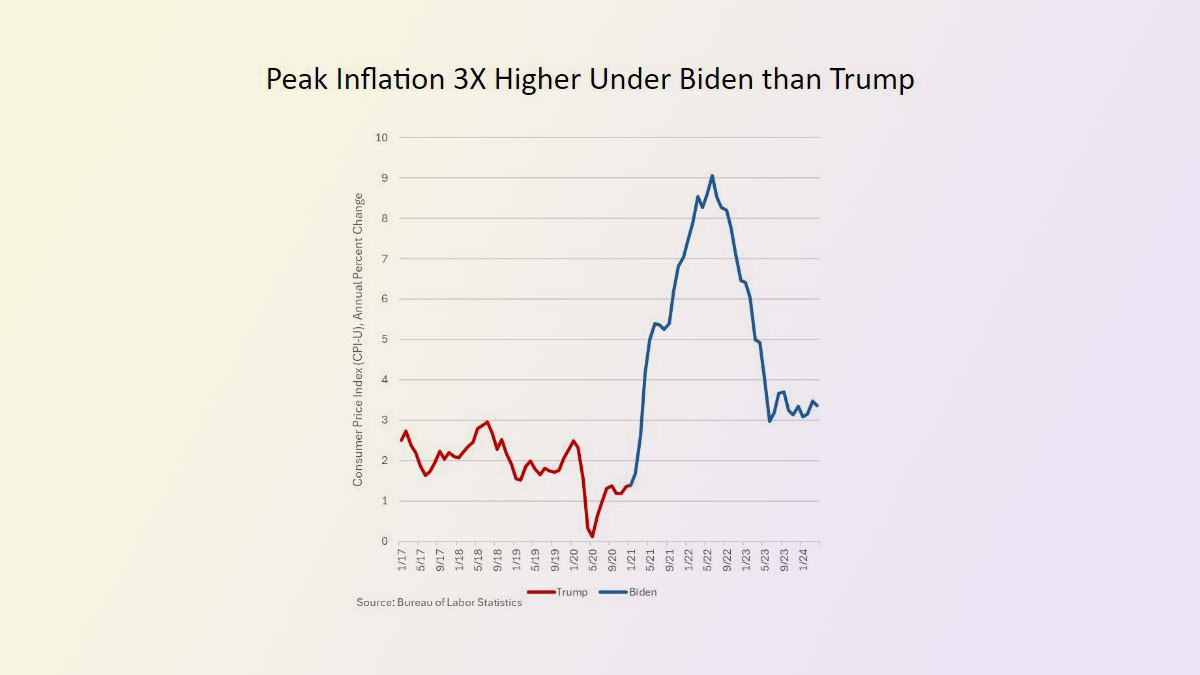

This is seen not just in the reckless Biden-Harris spending extravaganza masked by upside-down monikers such as “Build Back Better” or the “Inflation Reduction Act,” but across party lines and even centuries.

Notably, the largely forgotten S & L Crisis of the 1980s under the Reagan administration was never paid off: the proverbial can was simply kicked down the economic road (subject to compound interest, of course). The S & L debacle is estimated to have cost U.S. taxpayers some $132 billion, chump change by today’s debt measures. But that “crisis” caused the collapse of more than 1,000 U.S. banks and the insolvency of the Federal Savings and Loan Insurance Corporation.

That $132 billion in 1980s dollars has not yet been paid off – it was simply rolled into the national deficit, followed by decades of mostly deficit spending by both parties. The 2007-2008 financial crisis is estimated to have cost taxpayers some $498 billion, though President Obama famously lied to taxpayers in 2012, claiming the government recouped “every dime” used to rescue the banks he bailed out. Whatever the actual sum, it remains subsumed in the accumulated national federal deficit of about $35 trillion today.

Imagine running a household on infinite credit card debt, and you understand the federal government’s profligacy.

I am afraid America is on the precipice of a monetary disaster (to be “rescued” by an all-controlling digital currency). And I believe that even without interruptions of foreign oil supplies or Biden policies shrinking U.S. energy production and oil drilling, reckless U.S. monetary policy promises to drive the price at the pump for gasoline far above a paltry $100/gallon.

What do you say?

Come to the Financial Policy Council https://lnkd.in/eZU2UgYd, be a part of decisions that will shape the country’s future & share your thoughts.

Forecasting our Future January 2, 2025

Want to truly Drain the Swamp? December 15, 2024

Will Trumpism Go Global? December 8, 2024

Obliterating The Socialist/Communist Ideology for Good December 4, 2024

My Personal Opinion on Trump’s Dream Team November 19, 2024

Goodbye Washington Establishment October 25, 2024

Kamala Reinvents Freedom August 26, 2024

Why Kamala Harris has no chance August 21, 2024

AI and the destruction of America August 19, 2024

Have you ever thought about our future? August 17, 2024

Have you ever wondered what was the hashtag Reagan Revolution about? August 15, 2024

It’s ALL about Attitude folks August 9, 2024

About today’s new class of bureaucrats who call themselves “elite” August 5, 2024

Freedom or Slavery? Time to Choose August 3, 2024

Bitcoin’s Future August 1, 2024

Unlocking the Biden – Trump Quagmire July 4, 2024

Surviving and Prospering During the Upcoming Mayhem June 27, 2024

When People Have No Idea What They are Talking About…. June 25, 2024

Looking at the Future June 13, 2024

Luminaries at their best June 10, 2024

Money, Power, Control & Crypto June 8, 2024

Are you still looking for Liberty and Freedom or have you given up on it? June 6, 2024

Globalism and the New World Order will not survive May 31, 2024

Can the mismanagement of the Federal Reserve lead to much bigger problems? May 29, 2024

Is the Fed really this mindless? May 22, 2024

The Great American Wealth Creation Machine May 18, 2024

How Illiterate our Financial Press Is May 16, 2024

Are we headed to gasoline prices of $100/Gallon? May 14, 2024

Will Bitcoin determine the fate of the 2024 Elections? May 11, 2024

Is Everything on Social Media Fake? May 8, 2024

Is America headed for a Civil War? May 5, 2024

It’s the Economy Again ….. Stupid April 29, 2024

Why is the US Dollar in Big Trouble? April 25, 2024

Deepening Your Due Diligence Procedures April 20, 2024

Meet the Three “Powerbrokers” behind the Climate Change Agenda April 17, 2024

You own nothing and THEY will be happy April 15, 2024

Assessing Bidenomics track record April 13, 2024

How Private Interests Seized Control of America April 10, 2024

The Art of the Brainwash April 8, 2024

When Envy Meets Stupidity April 1, 2024

My Personal Forecasts for 2024 March 31, 2024

Taking Back Our Country March 30, 2024

Righting the Wrongs of Capitalism March 29, 2024

America’s Existential Threat: How real is it? March 27, 2024

Breaking Free March 26, 2024

Is the Justice Department Killing Capitalism? March 22, 2024

Let’s be honest folks March 19, 2024

Are we Done with the Western World? March 17, 2024

Why Time Has Come to Disobey? March 16, 2024

Revealing the World Economic Forum March 15, 2024

For those of you still rooting for Biden – Let this sink in March 14, 2024

What is the ladder out of poverty? March 13, 2024

What is turning the United States ‘Socialist/Communist’? March 11, 2024

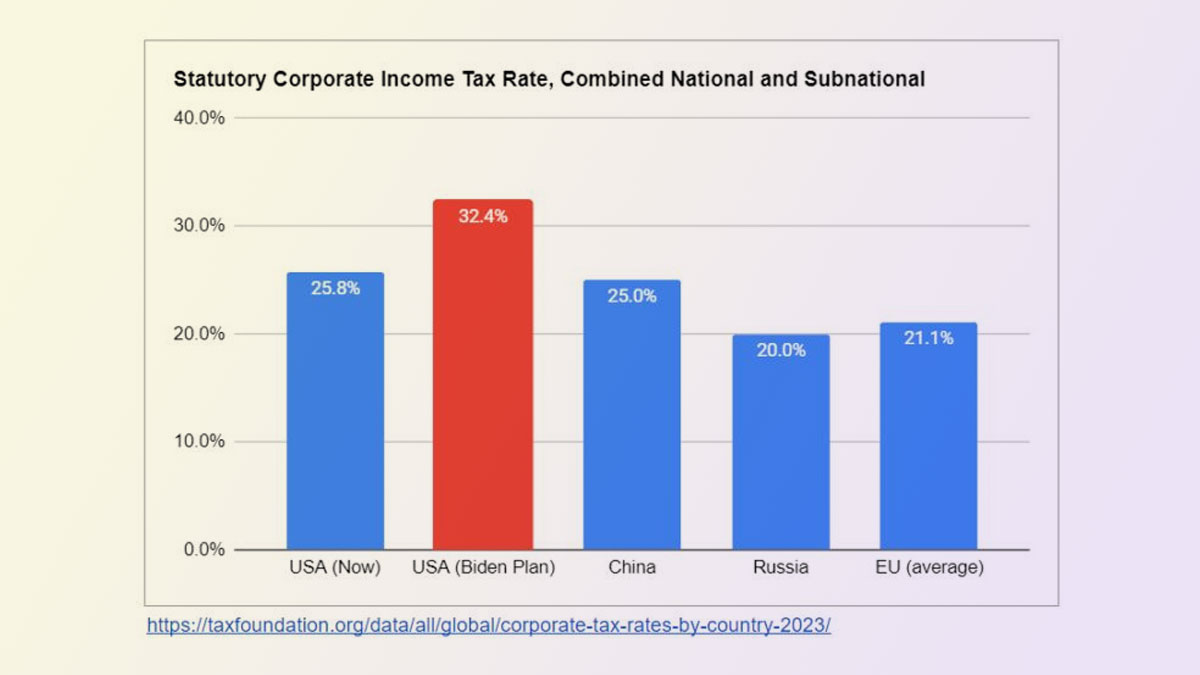

Growing the Economy With a Soak the Rich Tax Plan? March 8, 2024

Which presidential candidate should we vote for? March 6, 2024

Why your business proposals are failing March 1, 2024

Still a Puppeteer to the Puppet Masters? February 27, 2024

Unlocking the Master Code to Success February 24, 2024

An Open Letter to the “Global Elite” February 22, 2024

What is going on with our US Foreign Policy? February 19, 2024

Understanding the Billionaire Mindset February 16, 2024

Renewing Wealth Creation and the American Dream February 12, 2024

When Power Goes to People’s Heads February 8, 2024

Do you have what it takes to pitch to smart money? February 4, 2024

Smart v/s Dumb Money: How do you differentiate January 31, 2024

Why do so many socialists view making money as “Evil”? January 17, 2024

If you are so smart why aren’t you rich? January 12, 2024

Note: The Financial Policy Council (FPC) is a registered 501(c)(3) non-profit organization. This means that your generous donations to support our mission and initiatives are tax-deductible to the fullest extent permitted by law. To claim your tax deduction, please keep a record of your donation, including the date, amount, and any correspondence you receive from the FPC acknowledging your contribution. You should consult with your tax advisor to determine the specific tax benefits available to you based on your individual circumstances.